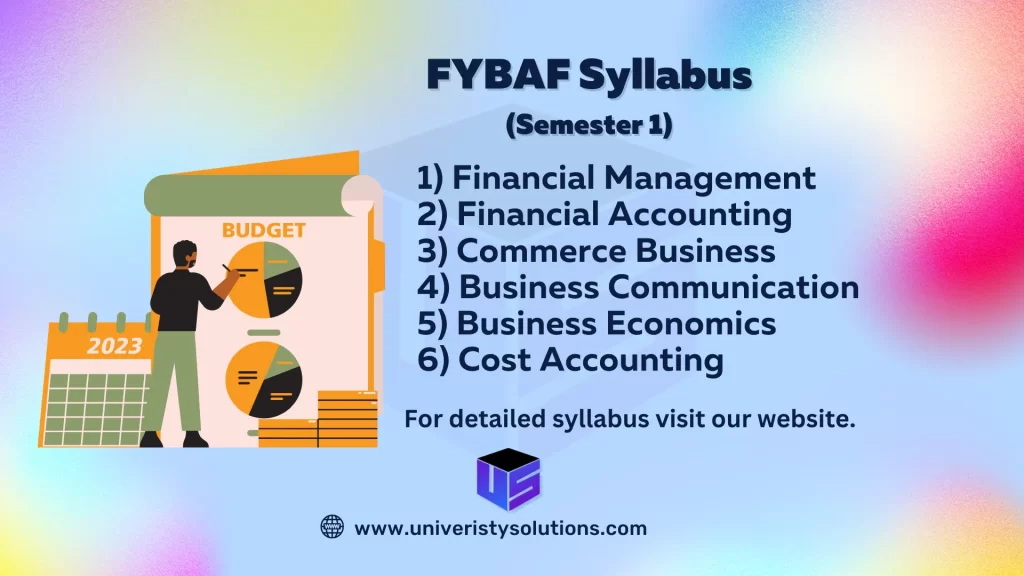

FYBAF Syllabus

(Semester 1)

FYBAF Means (First Year Bachelor of Accounting and Finance)

Following are the list of FYBAF Subjects (Semester I):

1) Financial Management-Introduction to Financial Management

2) Financial Accounting Elements of Financial Accounting

3) Commerce Business-Environment

4) Business Communication

5 Business Economics

6) Cost Accounting-Introduction and element of cost 1

7) Foundation Course-Commercial Environment

FYBAF Syllabus

Semester 1 (Chapters)

FYBAF Sem 1 Financial Management – I Syllabus

Chapter 1 – Introduction to Financial Management

a) Introduction

b) Meaning

c) Importance

d) Scope and Objectives

e) Profit vs Value Maximization

Chapter 2 – Concepts in Valuation

a) The Time Value of Money

b) Present Value

c) Internal Rate of Return

d) Bonds Returns

e) The Returns from Stocks

f) Annuity

g) Techniques of Discounting

h) Techniques of Compounding

Chapter 3 – Leverage

a) Introduction

b) EBIT & EPS Analysis

c) Types of Leverages : Operating Leverage, Financial Leverage & Composite Leverage

d) Relationship between Operating Leverage and Financial Leverage

Chapter 4 – Types of Financing

a) Introduction

b) Needs of Finance and Sources: Long Term, Medium Term, Short Term

c) Long Term Sources of Finance

d) Short Term Sources of Finance

Chapter 5 – Cost of Capital

a) Introduction

b) Definition and Importance of Cost of Capital

c) Measurement of Cost of Capital WACC

FYBAF Sem 1 Business Economics – I Syllabus

Chapter 1 – Introduction

Scope and Importance of Business Economics – basic tools – Opportunity Cost principle – Incremental and Marginal Concepts. Basic economic relations – functional relations: equations – Total, Average and Marginal relations – use of Marginal analysis in decision making

The basics of market demand, market supply and equilibrium price – shifts in the demand and supply curves and equilibrium

Chapter 2 – Demand Analysis

Demand Function – Nature of demand curve under different markets

Meaning, significance, types and measurement of elasticity of demand (Price, income cross and promotional) – relationship between elasticity of demand and revenue concepts

Demand Estimation and Forecasting: Meaning and significance – methods of demand estimation : survey and statistical methods (numerical illustrations on trend analysis and simple linear regression)

Chapter 3 – Supply and Production Decisions and Cost of Production

Production Function: Short run analysis with Law of Variable Proportions – Production function with two variable inputs – isoquants, ridge lines and least cost combination of inputs – Long run production function and Laws of Returns to Scale – expansion path – Economies and Diseconomies of Scale

Cost Concepts: Accounting cost and economic cost, implicit and explicit cost, fixed and variable cost – total, average and marginal cost – Cost Output Relationship in the Short Run and Long Run (hypothetical numerical problems to be discussed), LAC and Learning Curve – Break even analysis (with business applications)

Chapter 4 – Market structure : Perfect competition and Monopoly and Pricing and Output Decisions under Imperfect Competition

Short run and long run equilibrium of a competitive firm and of industry – monopoly – short run and long-run equilibrium of a firm under Monopoly

Monopolistic Competition : Equilibrium of a firm under monopolistic competition, debate over role of advertising (topics to be taught using case studies from real life examples)

Oligopolistic Markets : Key attributes of oligopoly – Collusive and non collusive oligopoly market – Price rigidity – Cartels and price leadership models (with practical examples)

Chapter 5 – Pricing Practices

Cost oriented pricing methods: cost – plus (full cost) pricing, marginal cost pricing, Mark up pricing, discriminating pricing, multiple – product pricing – transfer pricing

(case studies on how pricing methods are used in business world)

FYBAF Sem 1 Business Communication – I Syllabus

Chapter 1 – Theory of Communication

a) Concept of Communication :

Meaning, Definition, Process, Need, Feedback

Emergence of Communication as a key concept in the Corporate and Global World

Impact of technological advancements on Communication

b) Channels and Objectives of Communication :

Channels :

Formal and Informal – Vertical, Horizontal, Diagonal, Grapevine

Objectives of Communication :

Information, Advice, Order and Instruction, Persuasion, Motivation, Education, Warning, and Boosting the Moral of Employees

(A brief introduction to these objectives to be given)

c) Methods and Modes of Communication :

Methods :

Verbal and Nonverbal

Characteristics of Verbal Communication

Characteristics of Non-verbal Communication

Business Etiquette

Modes :

Telephone and SMS Communication

(General Introduction to Telegram to be given)

Facsimile Communication [Fax]

Computers and E-communication

Video and Satellite Conferencing

Chapter 2 – Obstacles to Communication in Business World

a) Problems in Communication/Barriers to Communication

Physical / Semantic or Language / Socio-Cultural / Psychological Barriers,

Ways to Overcome these Barriers

b) Listening

Importance of Listening Skills

Cultivating Good Listening Skills

c) Introduction to Business Ethics

Concept and Interpretation

Importance of Business Ethics

Personal Integrity at the workplace

Business Ethics and Media

Computer Ethics

Corporate Social Responsibility

Chapter 3 – Business Correspondence

a) Theory of Business Letter Writing

Parts, Structure, Layouts – Full Block, Modified Block, Semi-Block, Principles of Effective Letter Writing

Principles of Effective E-mail Writing

b) Personnel Correspondence

Statement of Purpose

Job Application Letter and Resume

Letter of Acceptance of Job Offer, Letter of Resignation

[Letter of Appointment, Promotion and Termination, Letter of Recommendation (to be taught but not to be tested in the examination)]

Chapter 4 – Language and Writing Skills

a) Commercial Terms used in Business Communication

b) Paragraph Writing

Developing an idea, using appropriate linking devices, etc.

Cohesion and Coherence, self-editing, etc.

FYBAF Sem 1 Business Environment – I Syllabus

Chapter 1 – Business and its Environment

(a) Business Objectives, Dynamics of Business and its Environment, Types of Business Environment

(b) Environmental Analysis: Importance, Factors, PESTEL Analysis, SWOT Analysis

Chapter 2 – Business and Society

(a) Business Ethics: Nature and Scope of Ethics, Ethical Dilemmas, Corporate Culture and Ethical Climate

(b) Development of Business Entrepreneurship: Entrepreneurship and Economic Development, Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, Entrepreneurship as a Career Option

(c) Consumerism and Consumer Protection: Consumerism in India, Consumer Protection Act 1986

Chapter 3 – Contemporary Issues

(a) Corporate Social Responsibility and Corporate Governance: Social Responsibility of Business, Ecology and Business, Carbon Credit

(b) Social Audit: Evolution of Social Audit, Benefits of Social Audit, Social Audit v/s Commercial Audit

Chapter 4 – International Environment

(a) Strategies for going Global: MNCs and TNCs, WTO

(b) Foreign Trade in India- Balance of Trade, FDI Investment Flows and its Implication for Indian Industries

FYBAF Sem 1 Cost Accounting – I Syllabus

Chapter 1 – Introduction to Cost Accounting

- Evolution

- Objectives and Scope of Cost Accounting

- Importance and Advantages of Cost Accounting

- Difference between Cost Accounting and Financial Accounting

- Limitations of Financial Accounting

- Definitions : Cost, Costing and Cost Accounting

- Classification of Cost on Different Bases

- Cost Allocation & Apportionment

- Coding System

- Essentials of Good Costing System

Chapter 2 – Material Cost

- Material Cost : The Concept

- Material Control Procedure

- Documentation

- Stock Ledger, Bin Card

- Stock Levels

- Economic Order Quantity (EOQ)

Chapter 3 – Labours Cost

a) Labour Cost : The Concept

b) Composition of Labour Cost

c) Labour Cost Records

d) Overtime / Idle Time / Incentive Schemes

Chapter 4 – Overheads

a) Overheads : The Concept

b) Classification of Overheads on Different Bases

c) Apportionment and Absorption of Overheads

Financial Accounting – I Syllabus

Chapter 1 – Accounting Standards Issued by ICAI and Inventory Valuation

a) Accounting Standards:

Concepts, Benefits, Procedures for Issue of Accounting Standards

Various AS :

AS – 1: Disclosure of Accounting Policies

(a) Purpose (b) Areas of Policies (c) Disclosure of Policies

(d) Disclosure of Change in Policies (e) Illustrations

AS – 2 : Valuation of Inventories (Stock)

(a) Meaning, Definition (b) Applicability (c) Measurement of Inventory

(d) Disclosure in Final Account (e) Explanation with Illustrations

AS – 9 : Revenue Recognition

(a) Meaning and Scope (b) Transactions Excluded (c) Sale of Goods

(d) Rendering of Services (e) Effects of Uncertainties

(f) Disclosure (g) Illustrations

b) Inventory Valuation

Meaning of Inventories

Cost for Inventory Valuation

Inventory Systems : Periodic Inventory System and Perpetual Inventory System

Valuation: Meaning and Importance

Methods of Stock Valuation as per AS – 2:

FIFO and Weighted Average Method

Computation of Valuation of Inventory as on Balance Sheet Date :

If Inventory is taken on a Date After the Balance Sheet or Before the Balance Sheet

Chapter 2 – Final Accounts

a) Expenditure : (i) Capital (ii) Revenue

Receipts : (i) Capital (ii) Revenue

b) Adjustments and Closing Entries

c) Final Accounts of Manufacturing Concerns (Proprietary Firm)

Chapter 3 – Departmental Accounts

Meaning, Basis of Allocation of Expenses and Incomes/Receipts

Inter Departmental Transfer : at Cost Price and Invoice Price

Stock Reserve

Departmental Trading and Profit & Loss Account and Balance Sheet

Chapter 4 – Accounting For Hire Purchase

Meaning, Calculation of interest

Accounting for hire purchase transactions by asset purchase method based on full cash price

Journal entries, ledger accounts and disclosure in balance sheet for hirer and vendor (excluding default, repossession and calculation of cash price)

Related Posts :

FYBAF Subjects

SYBAF Subjects

TYBAF Subjects

FYBAF Syllabus

SYBAF Syllabus

TYBAF Syllabus

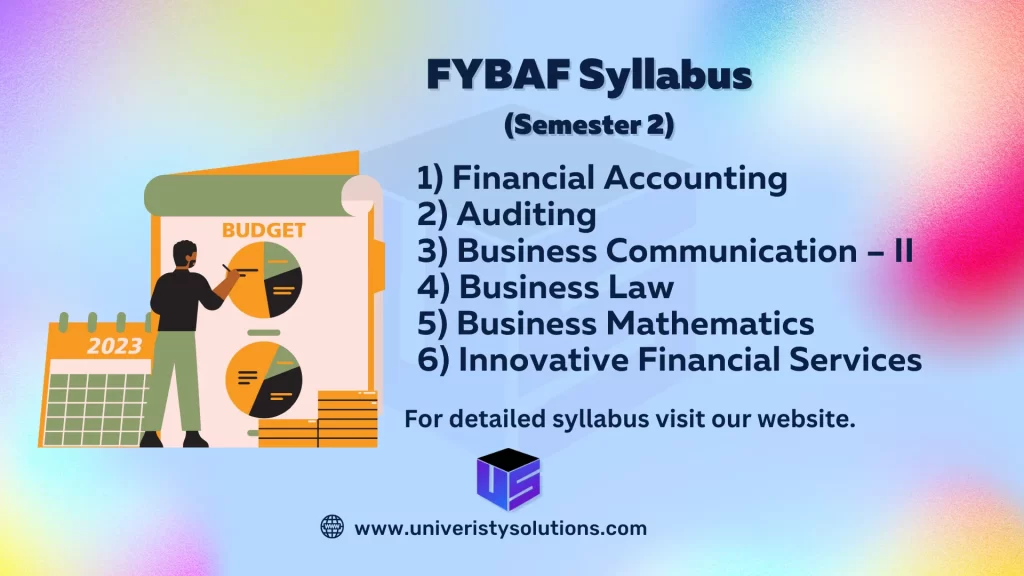

FYBAF Syllabus

(Semester 2)

Following are the list of FYBAF Subjects (Semester II) :

1) Financial Accounting-Special Accounting Areas

2) Auditing-Introduction and Planning

3) Business Communication – II

4) Business Law-Business Regulatory Framework

5) Business Mathematics

6) Innovative Financial Services

7) Foundation Course – II

FYBAF Syllabus

Semester 2 (Chapters)

FYBAF Sem 2 Financial Accounting – II Syllabus

Chapter 1 – Accounting From Incomplete Records

a) Introduction

b) Problems on preparation of Final Accounts of Proprietary Trading Concern

(Conversion Method)

Chapter 2 – Consignment Accounts

a) Accounting for Consignment Transactions

b) Valuation of Stock

c) Invoicing of goods at higher price

Chapter 3 – Branch Accounts

a) Meaning / Classification of Branch

b) Accounting for Dependent Branch not maintaining full books

c) Debtors Method

d) Stock and Debtors Method

Chapter 4 – Fire Insurance Claims

a) Computation of Loss of Stock by Fire

b) Ascertainment of Claim as per the Insurance Policy

c) Exclude: Loss of Profit and Consequential Loss

FYBAF Sem 2 Auditing Syllabus

Chapter 1 – Introduction to Auditing

a) Basics

Financial Statements, Users of Financial Information, Definition of Auditing, Objectives of Auditing – Primary and Secondary, Expression of Opinion, Detection of Frauds and Errors, Inherent Limitations of Audit

b) Errors and Frauds

Concepts, Reasons and Circumstances, Types of Errors – Commission, Omission, Principle and Compensating, Types of Frauds, Risk of Fraud and Error in Audit, Auditor’s Duties and Responsibilities in Respect of Fraud

c) Principles of Audit

Integrity, Objectivity, Independence, Confidentiality, Skills and Competence, Materiality and Work Performed by Others, Documentation, Planning, Audit Evidence, Accounting System and Internal Control, Audit Conclusions and Reporting

d) Types of Audit

Meaning, Advantages and Disadvantages of Balance Sheet Audit, Interim Audit, Continuous Audit, Concurrent Audit, Annual Audit

e) Miscellaneous

Advantages of Independent Audit, Qualities of Auditors, Auditing Vs Accounting, Auditing Vs Investigation, the Concept True and Fair View

f) Accounting Concepts Relevant to Auditing

Materiality, Going Concern

Chapter 2 – Audit Planning, Procedures and Documentation

a) Audit Planning

Meaning, Objectives, Factors to be Considered, Sources of Obtaining Information, Discussions with Client, Overall Audit Plan

b) Audit Programme

Meaning, Factors to be Considered, Advantages, Disadvantages, Overcoming Disadvantages, Methods of Work, Instruction before Commencing Works of Audit, Overall Audit Approach

c) Audit working Papers

Meaning, Importance, Factors Determining Form and Contents, Main Functions /Importance, Features, Contents of Permanent Audit File, Temporary Audit File, Ownership, Custody, Access of Other Parties to Audit Working Papers, Auditors Lien on Working Papers, Auditors Lien on Client’s Books

d) Audit Notebook

Meaning, Structure, Contents, General Information, Current Information and Importance

Chapter 3 – Auditing Techniques

a) Test Check

Test Checking Vs Routing Checking, Test Check Meaning, Features, Factors to be Considered, When Test Checks can be Used, Advantages, Disadvantages and Precautions

b) Audit Sampling

Audit Sampling, Meaning, Purpose, Factors in Determining Sample Size – Sampling Risk, Tolerable Error and Expected Error, Methods of Selecting Sample Items, Evaluation of Sample Results Auditors Liability in Conducting Audit based on Sample

c) Internal Control

Meaning and Purpose, Review of Internal Control, Advantages, Auditors Duties, Review of Internal Control, Inherent Limitations of Internal Control, Internal Control Samples for Sales and Debtors, Purchases and Creditors, Wages and Salaries

d) Internal Checks Vs Internal Control, Internal Checks Vs Test Checks

Chapter 4 – Internal Audit

a) Meaning, Basic Principles of Establishing Internal Audit, Objectives, Evaluation of Internal Audit by Statutory Auditor, Usefulness of Internal Audit

b) Internal Audit Vs External Audit, Internal Checks Vs Internal Audit

FYBAF Sem 2 Innovative Financial Services Syllabus

Chapter 1 – Introduction to Traditional Financial Services

a) Financial Services : Concept, Objectives / Functions, Characteristics, Financial Service Market, Financial Service Market Constituents, Growth of Financial Services in India, Problems in Financial Services Sector, Banking and Non-Banking Companies, Regulatory Framework

b) Factoring and Forfaiting : Introduction, Types of Factoring, Theoretical Framework, Factoring Cost, Advantages and Disadvantages of Factoring, Factoring in India, Factoring v/s Forfaiting, Working of Forfaiting, Benefits and Drawbacks of Forfaiting, Practical Problems

c) Bill Discounting : Introduction, Framework, Bill Market Schemes, Factoring v/s Bill Discounting in Receivable Management

Chapter 2 – Issue Management and Securitization

a) Issue Management and Intermediaries : Introduction, Merchant Bankers / Lead Managers, Underwriters, Bankers to an Issue, Brokers to an Issue

b) Stock Broking : Introduction, Stock Brokers, Sub-Brokers, Foreign Brokers, Trading and Clearing / Self Clearing Members, Stock Trading (Cash and Normal) Derivative Trading

c) Securitization : Definition, Securitization v/s Factoring, Features of Securitization, Pass through Certificates, Securitization Mechanism, Special Purpose Vehicle, Securitisable Assets, Benefits of Securitization, New Guidelines on Securitization

Chapter 3 – Financial Services and Its Mechanism

a) Lease and Hire-Purchase – Meaning, Types of Lease – Finance Lease, Operating Lease, Advantages and Disadvantages of Leasing, Leasing in India, Legal Aspects of Leasing

Definition of Hire Purchase, Hire Purchase and Installment Sale Characteristics, Hire Purchase and Leasing, Advantages of Hire Purchase, Problems of Hire Purchase

b) Housing Finance – Introduction, Housing Finance Industry, Housing Finance Policy Aspect, Sources of Funds, Market of Housing Finance, Housing Finance in India – Major Issues, Housing Finance in India – Growth Factors, Housing Finance Institutions in India, National Housing Bank (NHB), Guidelines for Asset Liability Management System in HFC, Fair Trade Practice Code for HFC’s, Housing Finance Agencies

c) Venture Capital – Introduction, Features of Venture Capital, Types of Venture Capital Financing Stages, Disinvestment Mechanisms, Venture Capital Investment Process, Indian Scenario

Chapter 4 – Consumer Finance and Credit Rating

a) Consumer Finance – Introduction, Sources, Types of Products, Consumer Finance Practice in India, Mechanics of Consumer Finance, Terms, Pricing, Marketing and Insurance of Consumer Finance, Consumer Credit Scoring, Case For and Against Consumer Finance

b) Plastic Money – Growth of Plastic Money Services in India, Types of Plastic Cards – Credit Card – Debit Card – Smart Card – Add-on Cards, Performance of Credit Cards and Debit Cards, Benefits of Credit Cards, Dangers of Debit Cards, Prevention of Frauds and Misuse, Consumer Protection, Indian Scenario

Smart Cards – Features, Types, Security Features and Financial Applications

c) Credit Rating – Meaning, Origin, Features, Advantages of Rating, Regulatory Framework, Credit Rating Agencies, Credit Rating Process, Credit Rating Symbols, Credit Rating Agencies in India, Limitations of Rating

FYBAF Sem 2 Business Law Syllabus

1. Law of Contract, 1872

- Nature of Contract

- Classification of Contracts

- Offer and Acceptance

- Capacity of Parties to Contract

- Free Consents

- Consideration

- Legality of Object

- Agreement Declared Void

- Performance of Contract

- Discharge of Contract

- Remedies for Breach of Contract

- Indemnity

- Guarantee

- Bailment and Pledge

- Agency

Chapter 2 – Sale of Goods Act, 1930

a) Formation of Contract of Sale

b) Goods and Their Classifications

c) Price, Conditions and Warranties

d) Transfer of Properties in Goods

e) Performance of Contract of Sales

f) Unpaid Seller and his Rights

g) Sale by Auction

h) Hire Purchase Agreement

Chapter 3 – Negotiable Instruments Act, 1881

a) Definition of Negotiable Instruments

b) Features of Negotiable Instruments

c) Promissory Note

d) Bill of Exchange and Cheque

e) Holder and Holder in Due Course

f) Crossing of a Cheque

g) Types of Crossing

h) Dishonour and Discharge of Negotiable Instrumens

Chapter 4 – Consumer Protection Act, 2019

a) Salient Features 221

b) Definition of Consumers

c) Deficiency in Service

d) Defects in Goods

FYBAF Sem 2 Business Mathematics Syllabus

Chapter 1 – Ratio, Proportion and Percentage

Ratio- Definition, Continued Ratio, Inverse Ratio

Proportion – Continued Proportion, Direct Proportion, Inverse Proportion

Variation – Inverse Variation, Joint Variation

Percentage – Meaning and Computation of Percentage

Chapter 2 – Profit and Loss

Terms and formulae, Trade discount, Cash discount, problems involving cost price, selling price, trade discount, cash discount.

Introduction to Commission and Brokerage – Problems on commission and brokerage

Chapter 3 – Interest and Annuity

Simple interest, compound interest,

Equated monthly instalments, reducing balance and flat rate of interest

Annuity immediate – present value and future value

Stated annual rate and effective annual rate

Chapter 4 – Shares and Mutual Fund

Shares- Concept, face value, market value, dividend, Equity shares, preference shares, bonus shares

Mutual Fund – Simple problems on calculation of net income after considering entry load, exit load, dividend, change in net asset value

FYBAF Sem 2 Business Communication – II Syllabus

Chapter 1 – Presentation Skills

a) Presentations : (to be tested in tutorials only)

Principles of Effective Presentation

Effective use of OHP

Effective use of Transparencies

How to make a Power-Point Presentation

Chapter 2 – Group Communication

a) Interviews – Group Discussion, Preparing for an Interview

Types of Interviews – Selection, Appraisal, Grievance, Exit

b) Meetings – Need and Importance of Meetings, Conduct of Meeting and Group Dynamics

Role of the Chairperson, Role of the Participants

Drafting of Notice, Agenda and Resolutions

c) Conference – Meaning and Importance of Conference

Organizing a Conference

Modern Methods : Video and Tele-Conferencing

d) Public Relations – Meaning, Functions of PR Department

External and Internal Measures of PR

Chapter 3 – Business Correspondence

a) Trade Letters :

Order, Credit and Status Enquiry, Collection (Just a brief introduction to be given)

Only following to be taught in detail :-

Letters of Inquiry, Letters of Complaints, Claims, Adjustments

Sales Letters, Promotional Leaflets and Fliers

Consumer Grievance Letters

Letters under Right to Information (RTI) Act

Chapter 4 – Language and Writing Skills

a) Reports :

Parts, Types, Feasibility Reports, Investigative Reports

b) Summarisation :

Identification of main and supporting / sub points, Presenting these in cohesive manner.

FYBAF Sem 2 Foundation Course – II Syllabus

Chapter 1 – Globalisation and Indian Society

Understanding the concepts of liberalization, privatization and globalization;

Growth of information technology and communication and its impact manifested in everyday life;

Impact of globalization on industry: changes in employment and increasing migration;

Changes in agrarian sector due to globalization; rise in corporate farming and increase in farmers’ suicides.

Chapter 2 – Human Rights

Concept of Human Rights; origin and evolution of the concept;

The Universal Declaration of Human Rights;

Human Rights constituents with special reference to Fundamental Rights stated in the Constitution.

Chapter 3 – Ecology

Importance of Environment Studies in the current developmental context;

Understanding Concepts of Environment, Ecology and their inter-connectedness;

Environment as natural capital and connection to quality of human life;

Environmental Degradation – Causes and Impact on human life;

Sustainable Development – Concept and components; poverty and environment

Chapter 4 – Understanding Stress and Conflict

Causes of stress and conflict in individuals and society;

Agents of socialization and the role played by them in developing the individual;

Significance of values, ethics and prejudices in developing the individual;

Stereotyping and prejudice as significant factors in causing conflicts in society.

Aggression and violence as the public expression of conflict.

Chapter 5 – Managing Stress and Conflict in Contemporary Society

Types of conflicts and use of coping mechanisms for managing individual stress;

Maslow’s theory of self-actualisation;

Different methods of responding to conflicts in society;

Conflict-resolution and efforts towards building peace and harmony in society.

Topics For Project Guidance : Contemporary Societal Challenges

(a) Increasing urbanization, problems of housing, health and sanitation;

(b) Changing lifestyles and impact on culture in a globalized world.

(c) Farmers’ suicides and agrarian distress.

(d) Debate regarding Genetically Modified Crops.

(e) Development projects and Human Rights violations.

(f) Increasing crime/suicides among youth.

Tips to score good marks in FYBAF Exam

- Don’t wait until the last minute to start studying: begin early. You’ll have more time to learn the topic and solve questions, the earlier you start.

- Remain arranged: Plan a study schedule and stick to it. Take time to rest and refresh during breaks.

- Regularly review your notes: Regularly reviewing back your notes will help you keep the content in your memory.

- Practice, practice, practice: By working through sample problems and completing sample tests, you can identify your areas of weakness and become familiar with the exam’s format.

- Ask for assistance if you need it: If you’re having trouble with the subject, don’t be shy to ask for assistance. You can seek advice from your teacher, a classmate, or a tutor.

- Get a good night’s sleep: The night before the exam, be sure to get lots of rest. A mind that has got enough sleep is better prepared to memorize and recall information.

- Arrive early on exam day: Arrive early on the day of the exam to give yourself time to settle your worries and mentally prepare.

- Stay focused during the exam: Avoid being distracted during the exam by remaining focused. Take a deep breath and return your attention to the activity at hand if you realize that your mind is roaming.

- Don’t waste too much time on any one question: keep an eye on the time. If you start to struggle, leave it and return to it later.

- Review your exam after you’re done: After you’re finished, review your paper for a while. By doing this, you’ll be able to correct any mistakes you may have made and provide any answers you’re not sure about.

Pingback: SYBAF Syllabus - Mumbai University | Semester 3 & 4 - University Solutions

Pingback: TYBAF Syllabus - Mumbai University | Semester 5 & 6 - University Solutions

Pingback: SYBAF Subjects - Mumbai University | Semester 3 & 4 - University Solutions

Pingback: TYBAF Subjects - Mumbai University | Semester 5 & 6 - University Solutions

Pingback: Financial Management TYBAF Sem 6 Question Paper | Free Download | Mumbai University - University Solutions

Pingback: FYBAF books pdf Free download | Mumbai university - University Solutions

Pingback: TYBAF Sem 6 Economics Question Paper | Free Download | Mumbai University - University Solutions

Pingback: FYBAF Subjects - Mumbai University | Semester 1 & 2 - University Solutions