Do you want to take charge of your financial future as a young person? Look no further than these best personal finance books, carefully chosen to assist you in accumulating wealth, choosing wise investments, and reaching financial independence. Let’s dive in and discover the contents of each book.

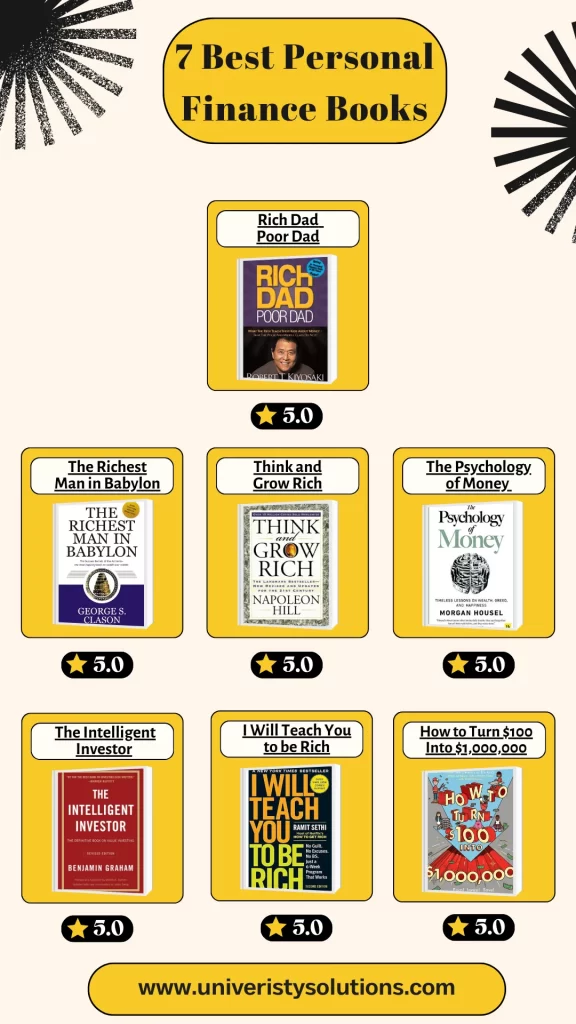

7 Best Finance Book for Youngsters

7 Best Finance Book for Youngsters which will teach about finance. In this blog post, we’ll look at a selected list of Best Finance Books for Youngsters that offer great insights into money management, prudent investment, and developing a solid financial foundation. I’ve chosen some that are straightforward and provide useful guidance.

1) Rich Dad and Poor Dad by Robert Kiyosaki

Summary: Without this book, no list of finance books can be considered comprehensive. Yes, it is a little outdated now. Written in 1997. But it still contains some insightful nuggets. The book “Rich Dad Poor Dad” by Robert Kiyosaki exposes readers to the idea of assets and obligations while also challenging traditional wisdom around money. Kiyosaki promotes a mentality shift that is essential for financial success through personal examples.

He presents ideas such as the cash flow quadrant, which highlights the benefits and drawbacks of each quadrant and classifies people as employees, independent contractors, business owners, or investors.

What You Will Learn: This book will teach readers how to think like a wealthy person, the distinction between assets and liabilities, and the value of financial knowledge. The book offers a road map for generating several revenue streams and questions conventional wisdom around money. The most important lesson you can learned from this is to prioritize purchasing assets above liabilities. Liabilities allow money to flow out of your pocket, whereas assets put money in your wallet.

Benefits to Read This Book: “Rich Dad Poor Dad” is an essential book for anyone hoping to take charge of their financial future and alter their perspective on money. Millions of individuals all across the world have benefited from this insightful and motivating book. This book aimed to inspire readers to work for themselves rather than for other people, in addition to providing ideas on how to get richer.

Quote from the Book: “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

About the Author: Robert Kiyosaki is a writer, investor, and entrepreneur who has devoted his professional life to imparting financial knowledge and entrepreneurship to others. He is the author of multiple best-selling books on personal finance and the creator of the Rich Dad Company.

2) The Richest Man in Babylon by George Samuel Clason

Summary: This classic personal finance book employs ancient Babylonian fables to offer timeless principles about money accumulation and financial success.

This timeless classic, which takes place in ancient Babylon, uses tales and parables to teach financial literacy. “The Richest Man in Babylon” discusses basic financial concepts like debt avoidance, investing, and saving. For young adults, the storylines’ simplicity makes it a compelling read.

What You Will Learn: Readers will learn the seven treatments for a lean pocketbook, which include living within your means, paying yourself first, and investing in income-producing assets. The book emphasizes the value of patience, dedication, and perseverance in reaching financial goals.

Why Should You Read This Book: “The Richest Man in Babylon” is a timeless classic that has motivated people to seek financial success for over 90 years. It’s a quick and easy read with a tremendous impact.

Quote from the Book: “A part of what you earn is yours to keep.”

About the author: George S. Clason, an American author, is best known for his work “The Richest Man in Babylon.” He was a successful entrepreneur and investor who used his knowledge to write about personal finance and wealth creation.

3) Think and Grow Rich by Napoleon Hill

Summary: The foundation of this timeless self-help book by Napoleon Hill is an extensive series of interviews with more than 500 accomplished people, such as Andrew Carnegie, Henry Ford, and Thomas Edison. Hill condenses their knowledge into a detailed manual for obtaining prosperity and success.

What You Will Learn: The 13 principles of success—desire, faith, autosuggestion, and the mastermind principle—will be revealed to readers. The book places a strong emphasis on the value of having a good outlook, making clear goals, and acting consistently.

Why Should You Read This Book: For more over eight decades, “Think and Grow Rich” has motivated individuals to realize their aspirations. It’s a timeless masterpiece that has withstood the test of time and is still applicable in the modern world.

Quote from the book: “Whatever the mind of man can conceive and believe, it can achieve”.

About the Writer: The most well-known work written by American motivational speaker and novelist Napoleon Hill is “Think and Grow Rich.” Andrew Carnegie hired him to conduct interviews with hundreds of prosperous people and condense their knowledge into a success formula.

4) The Psychology of Money by Morgan Housel

Summary: Morgan Housel looks into the psychological and emotional dimensions of money and how they impact our financial choices and actions in this perceptive book. This book dives into the behavior and emotions that impact financial decisions while examining the psychological aspects of money management. It really is among the best things I’ve ever read. It eloquently illustrates the issue that many individuals have in their connection with money with examples from everyday life.

What You’re Going to Discover: The impact that emotions, prejudices, and prior experiences have on how we view money will become clearer to readers. The book offers insightful advice on how to handle money better and steer clear of frequent financial blunders.

Why Should You Read This Book: Beyond the conventional recommendations, “The Psychology of Money” offers a novel and thought-provoking perspective on personal finance. Anyone who wants to make better financial decisions and succeed in the long run should read it.

Quote from the book: “The greatest superpower is the ability to save.”

About the Author: Morgan Housel is a partner at The Collaborative Fund and a former contributor at The Motley Fool and The Wall Street Journal. He is a highly sought-after author and speaker on investment and personal finance.

5) The Intelligent Investor by Benjamin Graham

Summary: a lot of people consider Benjamin Graham’s book to be the bible of value investing. With an emphasis on reducing risk and optimizing returns, it offers a thorough framework for stock and bond investing.

What You Will Learn: The fundamentals of value investing, such as the significance of diversification, long-term thinking, and margin of safety, will be revealed to readers. In addition, the book discusses issues including market psychology, portfolio management, and the investor’s responsibility.

Why Should You Read This Book: Anyone interested in stock market investing should read “The Intelligent Investor”. Although it’s a difficult book to read, anyone hoping to accumulate riches over time will find it well worth the effort.

Quote from the book: “The essence of investment management is the management of risks, not the management of returns.”

Author the Writer: The founder of value investing, Benjamin Graham was an American economist and investor. In addition to being a professor at Columbia University, he wrote seminal books on investing, such as “Security Analysis” and “The Intelligent Investor.”

6) I Will Teach You to be Rich by Ramit Sethi

Summary: Ramit Sethi’s book offers a six-week personal finance curriculum that teaches readers how to invest in index funds, automate their accounts, and negotiate better prices.

What You Will Learn: By automating bill payments, negotiating salary, and opening a high-yield savings account, readers will learn useful money management techniques. In addition, the book discusses investment, student loans, and credit cards.

Why Should You Read This Book: “I Will Teach You to Be Rich” is an excellent resource for young individuals just starting out in personal finance because it is realistic and actionable. It’s a straightforward, educational, and fun approach to money management.

Quote from the book: “There is a limit to how much you can cut but there is no limit to how much you can earn.

About the Author: Best known for his blog and podcast of the same name, Ramit Sethi is a personal finance guru and entrepreneur. His realistic and straightforward approach to money management has assisted millions of people in reaching their financial objectives.

7) How to Turn $100 Into $1,000,000 by James McKenna, Jeannine Glista, and Matt Fontaine

Summary: For preteens and young adults, this book offers an entertaining and interesting introduction to personal finance. It shows readers how to gradually accumulate riches by combining inspirational tales with useful advice.

What You Will Learn: In order to achieve financial success, readers will learn the value of compound interest, the necessity of regular saving and investing, and the necessity of patience and discipline. The book also addresses credit cards, entrepreneurship, and budgeting.

Why Should You Read This Book: Young individuals will benefit greatly from reading “How to Turn $100 Into $1,000,000” as an introduction to the world of personal finance. For readers of all ages, it’s the ideal quick read that is both enjoyable and educational.

Quote from the book: “The secret to getting rich is to start early and save often.”

About the Authors: James McKenna, Matt Fontaine, and Jeannine Glista are the co-founders of Money Confident Kids, a personal finance education firm. They have a strong desire to provide young people with the knowledge and abilities needed to succeed financially and become independent.

Conclusion

A strong grasp of personal finance in your 20s (and even in your teens) lays the groundwork for future financial security. if, for some reason, it isn’t always taught in schools, even if it should.

These lists of suggested readings for finance in your twenties offer a wide range of perspectives, from practical tactics to fundamental ideas.

Remember that the knowledge learned from these publications can help you make educated decisions, develop positive financial habits, and eventually attain your long-term financial goals.

Which of the best finance books for beginners do you recommend?

I invite you to recommend any important finance books that you believe should be included on this list. Your feedback is appreciated, and recommendations are welcome, as they can help improve this collection and help others on their path to financial literacy and independence.